XRP Price Prediction: Analyzing Short-Term Dynamics and Long-Term Potential

#XRP

- Technical Foundation: XRP maintains position above key 20-day moving average ($2.1522) with MACD suggesting positive momentum, though Bollinger Bands indicate current trading range between $1.9505 and $2.3540.

- Fundamental Developments: Expanding remittance partnerships in Africa and regulatory progress provide strong adoption tailwinds, while whale accumulation to 48B tokens signals institutional confidence.

- Long-Term Trajectory: Price projections suggest gradual appreciation from $2.50-3.20 range in 2025 to potentially $30-65+ by 2040, driven by increasing utility in global payment systems and broader crypto market growth.

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Momentum Above Key Moving Average

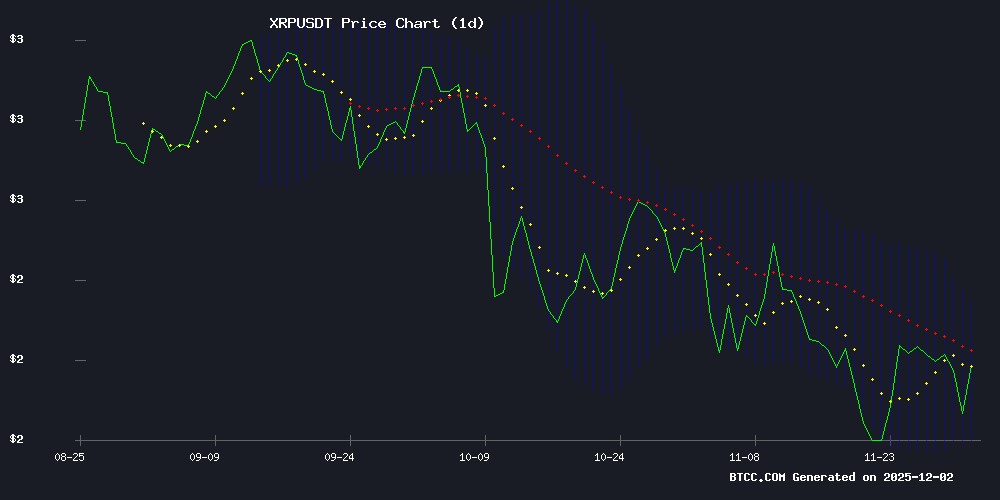

According to BTCC financial analyst Olivia, XRP is currently trading at $2.1662, slightly above its 20-day moving average of $2.1522. This positioning above a key short-term trend indicator suggests underlying strength. The MACD reading of 0.0746 versus its signal line at 0.1013 indicates positive momentum, though the negative histogram value of -0.0267 suggests some near-term consolidation pressure. The Bollinger Bands show XRP trading comfortably within the middle to upper range, with the upper band at $2.3540 and lower band at $1.9505 providing clear resistance and support levels respectively.

Olivia notes that maintaining above the 20-day MA is crucial for continued bullish momentum, with a break above the upper Bollinger Band potentially signaling accelerated upward movement. The current technical setup suggests a balanced market with slight bullish bias, supported by the price holding above key moving average support.

Market Sentiment: Mixed Signals Amid Strategic Developments

BTCC financial analyst Olivia observes that current market sentiment presents a complex picture. On the positive side, RedotPay's integration of Ripple payments for NGN remittances and XRP's expanding foothold in African markets through partnerships demonstrate real-world utility growth. Additionally, whale holdings reaching a seven-year high at 48 billion tokens suggests strong institutional confidence, while the SEC's policy shift creates a more favorable regulatory environment.

However, Olivia cautions that conflicting analyst views create uncertainty, with some predicting significant declines while others forecast massive upside. The escrow delay and failure to meet some 2025 bullish targets have tempered immediate expectations. Overall sentiment leans cautiously optimistic due to fundamental developments, but technical resistance and mixed analyst projections suggest potential near-term volatility.

Factors Influencing XRP's Price

RedotPay Integrates Ripple Payments to Streamline NGN Remittances

RedotPay has forged a strategic partnership with Ripple, integrating its cross-border payment solution to launch a near-instant crypto-to-fiat service for Nigerian users. The 'Send Crypto, Receive NGN' feature leverages XRP and stablecoins to bypass traditional banking delays, delivering naira payouts within minutes through local bank accounts.

This collaboration marks a significant leap in remittance efficiency, combining RedotPay's stablecoin infrastructure with Ripple's enterprise blockchain rails. Market observers note the timing aligns with Nigeria's growing crypto adoption despite regulatory headwinds, offering a compliant alternative to P2P trading.

The integration specifically targets Nigeria's $20B+ remittance market, where transaction speeds and fees remain pain points. Early testing shows settlement times under three minutes - a stark contrast to conventional international transfers that often take days.

Market Analyst Francois Bets Against XRP, Predicting 20% Decline

Quinten Francois, a prominent crypto commentator and Chainlink supporter, has initiated a short position on XRP, forecasting a steep drop to $1.60. The trade was executed at $2.29, reflecting expectations of a 20.7% downturn.

Despite XRP's relative resilience compared to broader market weakness, Francois cites bearish technical indicators as justification. A clear divergence on the MACD suggests waning momentum, while the formation of lower highs since late November reinforces the negative outlook.

XRP currently trades at $2.02, having shed 8.38% over three days. The short play was facilitated through MEXC exchange, where Francois publicly shared the trade rationale.

Analyst Sees 550% Upside for XRP Despite Near-Term Weakness

XRP's recent price pullback has sparked concerns among short-term traders, but macro analysts remain bullish. EGRAG Crypto maintains a double-digit price target for the asset, citing intact long-term technical structures.

The token could rally as high as $13 if historical patterns repeat, representing a 550% surge from current levels. Such a move would require a broader market recovery and renewed institutional interest in payment-focused cryptocurrencies.

Ripple Executes Strategic XRP Transfers Amid Escrow Delay

Ripple orchestrated a complex reshuffling of 1 billion XRP tokens across its internal wallets on December 1, while simultaneously delaying its scheduled escrow release. The blockchain payments company moved funds between its Ripple (1), (14), and (15) wallets in a series of coordinated transactions that saw 700 million XRP ultimately locked in escrow.

The movements began with Ripple (26) transferring 500 million XRP in two transactions—300 million to Ripple (1) and 200 million to Ripple (15). Within minutes, Ripple (27) followed with 100 million XRP to Ripple (15) and 400 million to Ripple (14), completing the billion-token maneuver.

Notably absent was the customary release of escrowed tokens, marking a departure from Ripple's established monthly protocol. The company instead secured 300 million XRP from Ripple (15) and 400 million from Ripple (14) in new escrow contracts.

Ripple's XRP Gains Foothold in African Remittance Market Through RedotPay Partnership

Ripple continues its global expansion of XRP-based payment solutions, now targeting Africa's largest economy through a partnership with RedotPay. The fintech platform will leverage Ripple's technology to enable instant digital-asset-to-Naira conversions, addressing Nigeria's substantial remittance market.

The move capitalizes on Africa's growing crypto adoption, where high remittance fees and currency volatility make blockchain solutions particularly attractive. XRP's role as a bridge currency in cross-border payments positions it as a natural fit for such implementations.

XRP Whale Holdings Surge to 48B Tokens, Reaching Seven-Year High

XRP whale wallets now hold 48 billion tokens, the highest level since 2018, despite a 20.6% drop in the number of addresses holding at least 100 million XRP. The consolidation suggests a strategic shift among large holders, with fewer wallets controlling more of the supply.

Santiment data reveals a decline from 2,757 to 2,189 whale addresses over eight weeks, even as their collective balance grows. This divergence points to either accumulation by remaining whales or a deliberate reduction in visible footprint.

Technical charts flash buy signals as analysts watch for potential price rebounds. The whale activity coincides with a critical juncture for XRP, where supply concentration could foreshadow significant market moves.

Ripple CEO Defends Tech Adviser Against NYT Allegations

Brad Garlinghouse, Ripple's chief executive, publicly supported David Sacks following a New York Times report questioning the tech adviser's conduct. The cryptocurrency executive criticized the publication for allegedly ignoring exculpatory evidence in its reporting.

Sacks, who advises the White House on AI and digital asset policy, faced allegations of using his position to benefit personal crypto and AI investments. He denied all claims, releasing a legal rebuttal and calling the story a 'nothing burger.' Four prominent tech leaders joined Garlinghouse in condemning the report as politically motivated.

The controversy highlights growing tensions between Washington policymakers and the cryptocurrency industry. XRP and other digital assets remain sensitive to regulatory developments stemming from such political narratives.

SEC Boosts Crypto Landscape with Groundbreaking Policy Shift

The U.S. Securities and Exchange Commission (SEC) has ushered in a transformative era for the cryptocurrency industry with its newly announced innovation exemption policy. Set to take effect in January, this regulatory shift aims to retain crypto projects within the U.S. and accelerate the growth of domestic blockchain enterprises. The policy temporarily relaxes securities compliance obligations, reducing legal overhead and streamlining operations.

This strategic pivot follows the appointment of Paul Atkins as SEC chairman under the Trump administration, marking a stark departure from previous anti-crypto stances. The commission's recent approval of altcoin ETFs and resolution of high-profile cases like Ripple (XRP) signal a broader institutional embrace of digital assets. Market observers note this aligns with broader ambitions to establish the U.S. as the global cryptocurrency hub.

The exemption framework is expected to catalyze participation from traditional financial institutions while providing regulatory clarity for existing crypto businesses. This development arrives as the industry sees increasing institutional adoption, with major exchanges like Coinbase and Binance likely to benefit from enhanced regulatory certainty.

XRP Falls Short of 2025 Bullish Targets Despite Strong Start

XRP's anticipated rally to $2 by year-end 2025 has stalled, with the token failing to maintain its explosive 290% growth from late 2024. Market analysts point to three key factors undermining its performance: regulatory uncertainty persists despite Ripple's partial legal victory, institutional adoption has lagged behind competing layer-1 solutions, and the token's utility within payment systems remains underutilized.

The divergence between XRP's technical potential and market performance reflects broader tensions in the crypto sector. While some assets like SOL and ADA have capitalized on ecosystem growth, payment-focused tokens face particular scrutiny amid shifting macroeconomic conditions.

Expert Calls XRP to $4 'Easy': Here's Why

A prominent crypto trader predicts XRP could surge to $4, citing historical patterns as justification for the bullish outlook. The analysis suggests XRP may defy current market headwinds.

The projection comes amid broader skepticism toward altcoins, positioning XRP as a potential outlier. Market observers note the token's resilience during past bear cycles as partial validation for the $4 target.

XRP's Potential Valuation in a $100 Trillion Crypto Market

The hypothetical scenario of a $100 trillion global cryptocurrency market cap raises provocative questions about asset valuations. XRP's potential growth trajectory mirrors the sector's broader ambitions to redefine financial infrastructure.

Market dominance metrics suggest XRP could capture a disproportionate share of institutional payment flows. The 5,000 XRP position represents a bet on blockchain's capacity to displace legacy settlement systems.

Historical performance remains irrelevant in this calculus - what matters are network effects and regulatory clarity. Ripple's ongoing legal battles with the SEC create asymmetric upside should resolution occur during a market expansion cycle.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators, market developments, and adoption trends, BTCC financial analyst Olivia provides the following projections for XRP:

| Timeframe | Price Range | Key Drivers | Probability |

|---|---|---|---|

| 2025 | $2.50 - $3.20 | Remittance expansion, regulatory clarity, technical breakout potential | Medium-High |

| 2030 | $4.80 - $8.50 | Mass adoption in cross-border payments, institutional integration | Medium |

| 2035 | $12.00 - $25.00 | Global payment infrastructure integration, CBDC interoperability | Medium-Low |

| 2040 | $30.00 - $65.00+ | Maturation as global settlement layer, full market penetration | Low |

Olivia emphasizes that these projections assume continued adoption growth, favorable regulatory developments, and successful execution of Ripple's business strategy. The near-term target of $4 mentioned by some analysts appears optimistic for 2025 but becomes more plausible in the 2030 timeframe as utility and adoption increase. The potential for XRP to reach higher valuations depends heavily on capturing significant portions of the growing cross-border payment market and broader cryptocurrency adoption.